Why You Should Pay Medical Expenses From Savings Instead Of Your HSA

July 24, 2017My colleagues and I have quite the debate going about the merits of using your Health Savings Account (or HSA) versus excess savings to pay for medical expenses. (yes, this is what CFP®’s call “fun”) After all, isn’t the whole purpose of your HSA to pay for medical expenses? What’s the point if you’re just going to spend other savings when you incur medical bills anyway? Well, I have to admit that after running the numbers, it actually makes sense under certain assumptions. Stick with me here.

First of all, the assumptions

Let’s assume you have a cash reserve of at least 6 month’s essential expenses, no high interest rate debt, are saving up to the match in your 401(k) and also have extra savings set aside. In other words, you have the flexibility to pay medical expenses from somewhere other than your HSA if you wanted to. (Short answer if you don’t have these assumptions met: use your HSA.)

Growth of your savings account

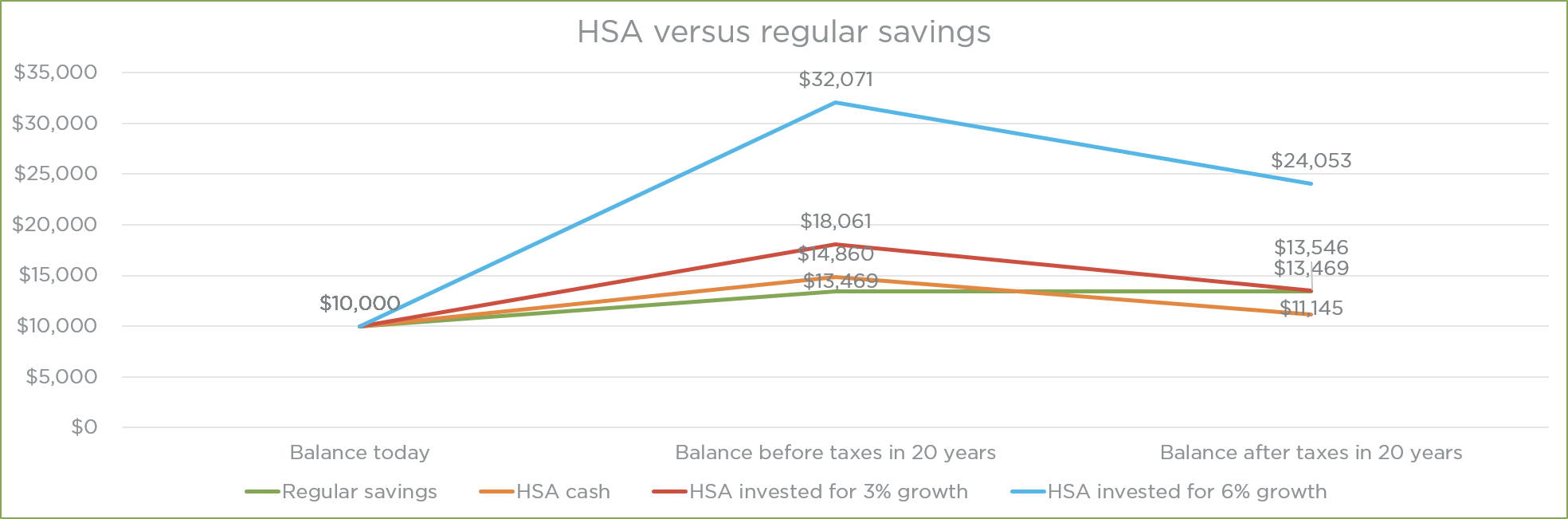

Now let’s also assume that you are 45 and have $10,000 in extra savings and a $10,000 balance in your HSA. In today’s interest rate environment, your savings account is probably earning basically 0%, but let’s assume you earn 2% interest, and that you are in the 25% federal income tax bracket. That makes your effective interest rate 1.5%. Projecting that out, in 20 years your savings account would grow to $13,469 by the time you were age 65.

Growth of your HSA

Now let’s look at that scenario inside your HSA. Because HSA money grows tax free, the effective interest rate would be the full 2%, which means that in 20 years your account would grow to $14,860. If you waited until you were age 65 and then withdrew your full balance all at once for a non-medical expense and were still in the 25% tax bracket, then you would pay $3,715 in taxes for a net of $11,145, which would be less than your traditional savings account. (Remember that HSA withdrawals are tax-free for medical expenses no matter when you withdraw, but once you’re 65, you can actually use your funds for anything, just like your 401(k) — you just have to pay taxes on the money if you use it for non-medical.)

The caveat

“But wait,” you might be asking, “can’t I invest my HSA?” Yes you can once you accrue a certain balance set by your HSA provider, which means that even if you invest it conservatively to earn 3%, your HSA balance would grow to $18,061, which after you pay $4,515 in taxes will net you $13,546 — more than your savings account. If you take a more aggressive investment approach and are able to grow your HSA by 6%, then you’d end up with $32,071 which after paying taxes of $8,018 would net you $24,053.

The bottom line is that if you are able to earn a higher tax equivalent yield in your HSA than you traditional savings account, it makes sense to let your HSA accrue and grow, even if you DON’T end up using it for medical expenses in retirement. Obviously if you end up using it for medical expenses, even after 65, it’s an even better deal. The other bottom line is I can’t wait for football season, so the geeks and I (excuse me, my colleagues and I) can talk about something else.

Want more helpful financial guidance, delivered every day? Sign up to receive the Financial Finesse Tip of the Day, written by financial planners who work with people like you every day. No sales pitch EVER (being unbiased is the foundation of what we do), just the best our awesome planners have to offer. Click here to join.