How To Approach Investing As Retirement Draws Closer

August 15, 2018One of the things I discuss quite a bit with employees that are approaching retirement is how they should structure their investments as retirement draws closer. Many times, they are considering becoming more aggressive over their last few years in the workforce to try and boost returns and maximize account values. This can be a recipe for delayed retirement if the timing is wrong.

The fundamentals

While the fundamentals of investing – being mindful of how long until you need the money and your risk tolerance – do not change as you approach (or enter) retirement, conventional wisdom says you should really want to take less risk as you approach retirement. The idea being you have less time to recover from market losses than you did earlier in your career.

It’s a (hopefully) long road ahead

But, you don’t want to just plow everything into a stable value fund or cash either. Retirement can last upwards of 30 years or more, so you want some aggressive investments to help that money grow and last. You may be thinking, “OK you’re telling me to be more conservative, but stay aggressive – which one is it?”

Well, like many things in financial planning, it depends. Let’s look at some strategies to help you decide how to best manage your own nest egg as you approach retirement.

Exploring the fundamentals

At any point in your financial life, sticking to the fundamentals is the best way to be a successful investor.

- When do you need the money? Money you know you will need to spend in the next 5 years should be invested conservatively. Investments like a CD, money market mutual fund, or a stable value fund protect those funds from dramatic market movements.

- What is your risk tolerance? Knowing how you feel about risk is crucial in setting up your investment allocation. There are investors in their 20s or 30s that are very conservative by nature, just like there are investors in their 70s and 80s that are aggressive. Staying true to your risk tolerance allows you to be comfortable with the risk you are taking, which makes you much more likely to stay with your strategy when markets are down.

- Don’t react to market moves. This one is easier said than done because it contradicts our human nature. For most of us, the pain of losing value in our accounts is stronger than the joy we feel when our accounts are growing. Selling stock investments at low points locks in losses as we are often selling low after buying high. It’s best to resist watching the market on a day-to-day basis.

- Rebalance regularly. At least once per year, make sure your allocation reflects your original strategy. If your goal is to have 60% in stocks, 30% in bonds, and 10% in cash, check to make sure that is how your funds are set up. In a year when stocks have done well, you may find yourself with 70% in stocks and 20% in bonds. It can be tempting to keep riding the wave of a bull market, but it’s better in the long run to lock in the gains and stick to your original mix. Rebalance by selling enough of the stock investments (sell high) to get back to your target, then buying enough of the bond investments (buy low) to get back to your target there.

The bucketing strategy

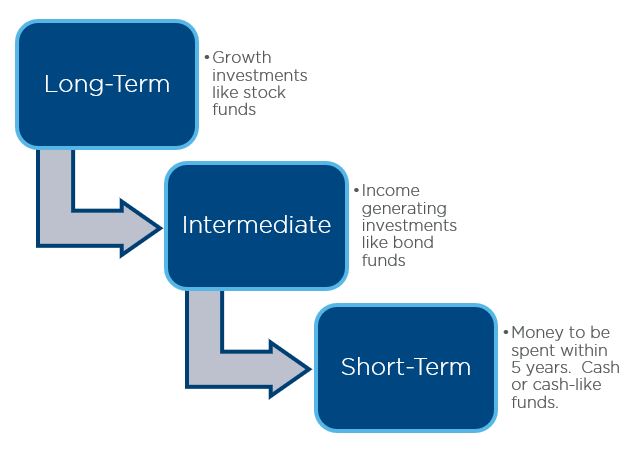

When it comes to making investment changes as you approach retirement, one popular strategy is to think of putting your money in hypothetical buckets.

- The first bucket is your short-term funds – money you know you will spend in the next 5 years. This bucket can be thought of almost as a savings account and be very conservatively invested.

- The second bucket is your intermediate bucket and should be invested in things that generate income, like bond funds. This is money you’d anticipate withdrawing after 5 years, but before 10 years. This bucket is used to refill your short-term bucket as you spend from it.

- The third bucket is your long-term bucket and holds your aggressive investments (think stock funds) and is designed to drive growth. This is the bucket that can help your savings to last those 30+ years you’ll hopefully have in retirement.

Rule of thumb

Another way to look at it is by using a common rule of thumb that says the best balance is investing a percentage in stocks equal to 120 minus your age. So if you are 58, then 62% of your funds would be in stock funds. You may try this rule of thumb, along with the 5-year bucket if you find that simpler.

Final thoughts

As you approach retirement, it is a wonderful time to revisit your retirement accounts and make sure you are in line with your risk tolerance and following good fundamentals. Take some time to review your budget and spending needs over the next couple years, which will help you to clarify how much goes into each bucket. Having your money split into the different buckets can help make sure you have the right balance of safety, income, and growth. This will help your money last as your enjoy your retirement!