Worried About A Market Bubble? Here’s What To Do

October 04, 2018When market returns have been positive for a while (like the reasonable, respectable year-to-date return just north of 8% on the S&P500 as of 9/24/2018 shown below), I’ve noticed that not too many people are complaining about earning “only” 4% back in mid-June (or 1.5% at the end of June – yikes!).

Instead, we stop worrying about not making money (when the markets are down or sideways) and we begin to worry about losing the gains we have made. I’ve had more than a few people ask me lately if the next stock market “bubble” is here. It seems we are never quite satisfied unless we can worry about something, even when things are going well.

Loss aversion

Psychologists and behavioral finance specialists have a term for this sinking feeling: loss aversion. When our minds begin to flirt with loss aversion, our thoughts and discussions focus on words like “bubbles” and we begin to deliberate over the various negative outcomes that could happen (but haven’t) and what we should do about them.

Mostly we worry. Sometimes we panic. The reactive lizard portion of our brains then kicks in and we make bad financial decisions (like moving 100% of our investments to cash). Why? Because our reference point has shifted – we don’t want to “lose” that additional 4% we made from June to September.

There’s just no way to know

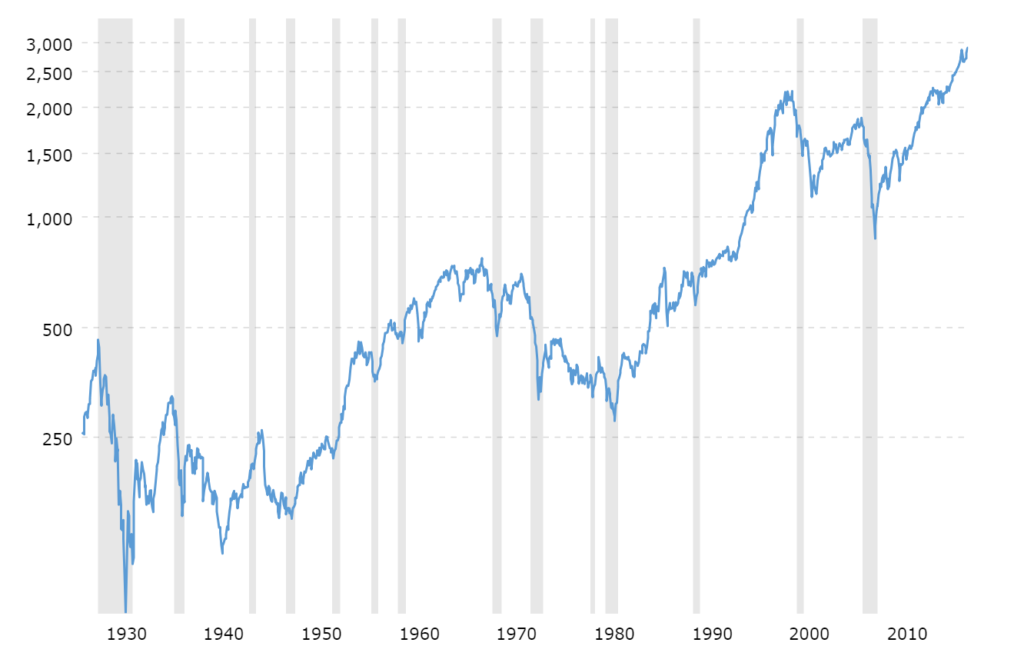

While it can feel right to protect ourselves from these potential losses, it is almost always the wrong move to make. Why? The easy answer is, none of us has a crystal ball. Not me. Not you. Not Warren Buffett. No one. Looking back at the stock performance chart, which way will the line move next? No one knows. It is simply unknowable. The market giveth, and the market taketh away. But in the long run, the market generally giveth, does it not?

I’m not always so sure about that, either, but history is a pretty good indicator. Let’s go all the way back to 1926 and look at what arguably represents a (long) lifetime of investing. Looking at this next chart, there have certainly been some lengthy periods where investing in the stock market surely was not much fun. The mid-sixties through the mid-eighties come to mind; as does the so-called “lost decade” between 1998 and 2008. Ten or more years can be a long time to invest and feel like you might have been better off stuffing cash into your mattress.

What’s the alternative?

Despite some ugly short term performance (remember, stock investing is a long term game), stocks are still the best producing asset around. Better than bonds. Better than real estate. And yes, better than gold. (Don’t get me started on cryptocurrencies). However, I wouldn’t suggest keeping all of my money in stocks, either. When those inevitable dips do take place, those other asset classes (bonds, cash, real estate, etc.) are exactly the performance buffers you will need to offset the temporary stock dips.

How to manage stock risk

If the mantra for real estate is location, location, location, for investing it is diversify, diversity, diversity. Timing the market doesn’t work. Even the experts fail at that strategy. A successful investment approach is also generally a dull, boring approach:

- Spread your money across different investment types – stocks, bonds, some cash, and even real estate if you are so inclined. Asset allocation is your friend.

- Measure your risk tolerance from time to time and rebalance only when necessary.

- Be very, very patient.

- Ride out the next stock market dip; your (wealthier) future self will thank you.

When all else fails, do this

You’ve done it. You took steps to get in touch with your individual tolerance for risk, diversified your investments accordingly, and promised yourself to leave your investments alone and let them do their work for you. However, the news, noise, and chatter about the latest market “bubble,” “crash,” or “nosedive” is causing the inner recesses of your brain to twitch and second guess yourself. You really feel like you should be doing something – anything – because doing nothing feels like the wrong thing to do.

I couldn’t agree more. Doing nothing can feel like helplessness. When the market gets frothy and investors (including me) get nervous, here’s what I do:

- Turn off the news (radio, TV, Internet, smartphone – all of it).

- Go for a run (or a walk on the beach).

- Take my sweetie out to dinner.

- Paddle my kayak (or standup paddle board).

- Go fishing.

- Keep investing.

You and I can’t change the financial markets. They are going to do what they are supposed to do. We can choose to change how we react to them, however.