How To Make Sense Of All The Different Credit Scores

January 17, 2019There was a time when your credit score was your credit score. It was one number, and the higher it was, the better your life was (at least from a borrowing perspective). Lately, you have probably noticed there is more to credit scores these days than just your FICO® score. Now we have VantageScore and even UltraFICO™ (whatever that is?). Let’s take a look at all of these to decide what you need to worry about (or not).

FICO®

In 1981, the Fair Isaac Corporation, FICO®, created the first credit risk score and quickly became the primary credit scoring company in the United States. Whenever we apply for credit, potential lenders want to know how likely we are to pay them back on time. Before FICO® scores came along as a standard way to measure credit risk, individual lenders more or less used their own criteria to determine whether or not to lend you money. (Yes, they made it up as they went along).

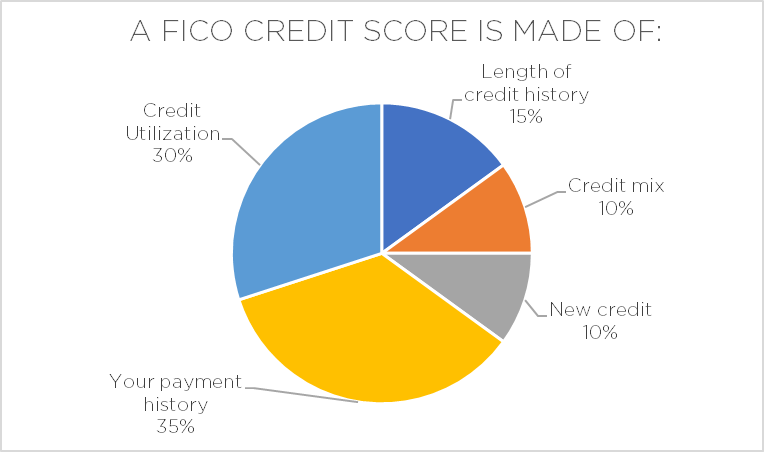

Now many lenders rely on your FICO® score instead, a three-digit number ranging from 350 to 850 (or 900 for some industries), with a higher score indicating better creditworthiness. Over time, many more credit risk models have evolved under the FICO® umbrella, so FICO® is more of a brand than an individual score these days.

VantageScore

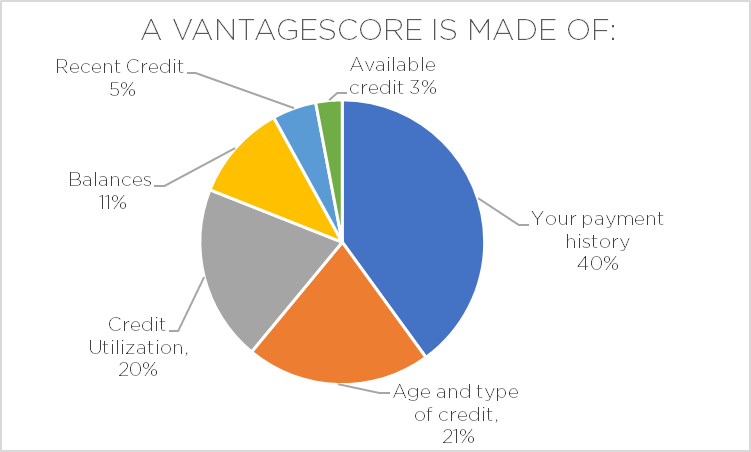

Equifax®, Experian®, and TransUnion®, the three major credit reporting agencies, combined forces to establish yet another credit scoring model, VantageScore. They kept the 350 – 850 scoring range, but how various credit behaviors are evaluated within the model varies somewhat from the FICO® method. For example, both methods evaluate things like late payments, utilization, length of credit history, etc., but they assign different levels of importance or weight to these criteria. The graphic below illustrates how VantageScore measurements differ from those of FICO®.

UltraFICO™

As the saying goes on TV infomercials, “But wait; there’s more!” Someone who is just starting out or starting over with building a positive credit history can find it challenging to obtain credit without first having had credit. Introducing UltraFICO™, a new offering from the folks at FICO, pioneers in the development of credit score analytics, that allows consumers to link their checking and savings accounts to their credit score.

Although checking and savings accounts are typically not included as part of your traditional credit score, demonstrating evidence of responsible financial behavior by keeping a positive bank balance and regularly paying bills can help build your UltraFICO™ score. Working jointly with Experian, one of the major credit scoring institutions, UltraFICO™ scores will initially be available (at the time of this writing) through a limited group of lenders as part of a pilot phase for consumers who may not have access to credit or who might be eligible for better credit terms.

This initial pilot phase is being used to fine-tune of the launch of this new scoring model. Following the pilot phase, the UltraFICO™ Score is expected to become more widely available. If you are interested in participating in this program and obtaining your own UltraFICO™ score, visit their website and complete a brief online form.

Why different scoring models?

As with all things in the marketplace, demand drives supply. In the world of lending, one size does not fit all, and different lenders across a variety of industries still prefer to evaluate potential borrowers according to their own models, so a variety of credit scoring models has evolved to cater to lender needs. Keep in mind, the credit scoring and reporting entities make money by selling scores to lenders, so they periodically offer something “new and improved” to help their lending customers make more informed decisions.

What does it mean for you?

While it can be confusing to figure out why your FICO® score is one number and your VantageScore is a different number, in the big scheme of things, the numbers themselves are not all that important. Yes, a higher score is better than a lower score, but the more critical measures of our financial wellbeing remain the same, regardless of credit scoring model:

- Do we have enough extra cash on hand (emergency fund)?

- Are we saving enough for retirement?

- Do the bills get paid on time (no late payments)?

- Are we using a strategy to pay off consumer debt quickly?

I still keep track of my credit scores, of course, mainly as a way to see if anything unusual might be going on. When it comes to focusing on specific numbers, though, I’m more concerned about meaningful values like blood pressure & cholesterol than I am about FICO® and VantageScore. In fact, the less I worry about those last two values, the better I do with the first.