Q&A with Financial Finesse CEO, Liz Davidson

May 06, 2020Financial Finesse’s 2019 Year in Review Research Study & The Impact of a New Normal Post COVID-19

View the entire COVID-19 best practices abstract “The Impact of a New Normal” here.

1. Question: What were the most significant takeaways from the 2019 Year in Review report?

Answer: For this year’s report we looked at how engagement in online, group, and individual learning sessions influence change in financial wellness as measured by the Financial Finesse Financial Wellness Score. The results were astounding.

Employees that engaged in group learning improved their financial wellness score on average 1.11 points, 40% higher than the 0.79-point average improvement by those that engaged exclusively online. But it was the employees that followed the best practice model and engaged in all three forms of learning that topped them all, improving their financial wellness score on average 1.44 points, outperforming group learners by 31% and online-only learners by 83%.

This improvement in financial wellness also translated into improvement in benefit participation. Employees that engaged in the best practice model had a 43% higher retirement plan deferral rate and an 81% higher annual contribution to a health savings or flexible spending account than employees that only engaged online.

We also found that the greatest net improvement—which is the difference between improvement by those that engaged in the best practice model and those that engaged exclusively online—occurred among employees with the lowest levels of financial health. What is even more remarkable is the speed of improvement. Financially stressed employees exhibited the greatest degree of improvement in the shortest amount of time across all levels of engagement.

2. Question: What can employers leverage from the 2019 Year in Review report to help employees navigate the financial impacts of COVID-19?

Answer: In the wake of the COVID-19 pandemic, we are seeing signs of increasing financial stress associated with the stock market and U.S. economy manifesting itself as a lack of trust in sources of financial guidance and concern for not reaching future financial goals. When considering the relationship between physical health, workplace productivity, and financial stress, this should have employers’ attention. The good news for employers is that the best practice model yields the greatest improvement in financial wellness for the most financially stressed employees in the least amount of time. These results could not have come at a better moment in history.

As the pandemic persists, we expect to see a shift toward lower levels of financial health across the global workforce. Given the strong relationship between financial health and employment cost, we encourage employers to focus their COVID-19 efforts on providing financial resources and support to their most financially stressed populations first. This population can be defined through a workforce financial wellness assessment, a demographic analysis, or by measuring financial stress metrics such as retirement plan leakage, garnishment, or benefit utilization. Once the at-risk population is defined, consider offering ongoing financial coaching delivered through a multi-channel model if possible.

3. Question: What drives the trend of end-users in the lowest tiers of financial health exhibiting the greatest level of improvement in the shortest amount of time?

Answer: The emotional courage it takes to confront serious financial issues is significant. Finances still remain taboo, especially for those who are struggling financially, and there’s often a sense of shame or helplessness they have to overcome. The best practices model is well suited to mitigate that, because it is set up to reduce barriers as a financial wellness benefit that can be accessed however employees feel most comfortable, and then migrate to ongoing financial coaching when they are ready. The message they get is “We are all in this together. Everyone has financial challenges. You are not alone and there is nothing to be ashamed of.” That alone makes a huge difference.

Then when you consider the small wins in finding ways to reduce expenses by getting better deals on essential items, get credit relief or lower interest rates, begin the process of starting an emergency fund, can make a huge difference to financial stability, it makes sense that those who struggle most would improve the most with a model that provides unlimited financial coaching through multiple channels.

4. Question: On average, which aspects of an employee’s financial wellness improved the most under the best practices model?

Answer: On average, employees that engaged in the best-practice model for five or more years showed a 1.59-point improvement (on a 10-point scale) in financial wellness score. The greatest net difference between improvement among employees who engaged exclusively online and those that engaged in the best practice model occurred in the areas of retirement planning and investing. Employees that engaged in all forms of learning also had a 43% higher retirement plan deferral rate and an 81% higher annual contribution to an HSA or healthcare FSA than employees that engaged exclusively online. They were also more likely to have a handle on cash flow, have an emergency fund, pay bills on time, be comfortable with debt, and pay off credit card balances in full.

5. Question: How do you anticipate COVID-19 may alter the traditional compensation and benefits structure most workplaces have become accustomed to? Do you anticipate a potential or temporary decrease or suspension of benefits like 401(k) matching, PTO, etc., as employers explore potential cost-savings strategies to avoid having to layoff or furlough employees?

Answer: Many employers are considering any practical cost-saving measures to stay afloat during this crisis. However, rather than decreasing or suspending benefits that impact some, I believe we will see a strategic refocus of attention and funds, where available, towards benefits thought to be more flexible and impactful across the board, like HSA’s for example.

That said, I believe COVID-19 will cause a major mind shift in how we think about employee benefits, in line with human-centered design principles, where the focus shifts from the benefits themselves to the employee’s individual financial needs, integrating benefits in a way that best meets their financial security. This includes:

- Increased personalization of benefits so each employee can design their own benefits package that best meets their needs, with the help of digital and phone based financial wellness platforms that guide them through the decision-making process.

- Increased focus overall on workplace financial wellness as an employee benefit. Employers are actively looking for support in helping their employees through COVID-19 financially and I believe these efforts will quickly morph into a much deeper commitment to financial wellness as a standalone benefit. Our business more than doubled in Q1 2020 vs. Q1 last year and is only gaining momentum as more employers look for proven and cost-effective strategies to help promote their employees’ wellbeing and financial security.

6. Question: According to PayScale, the gender pay gap has improved 7% since 2015. Why do you think the gender gap in financial wellness continued to widen for women in 2019 despite a narrowing of the gender pay gap over the last several years?

Answer: Historically, the gender gap tends to widen in periods of economic expansion and narrow in periods of economic contraction. This has held true throughout the duration of our research. Based on the data, men tend to be more confident and aggressive in their investment strategies during bull markets, which puts them in a better position financially at the time, but also creates more risk in the event of a market downturn. Women, on the other hand, tend to be more conservative, but also more resilient and take a more active role in managing their finances in a down market. Since 2019 was a strong year for the market and economy overall, the gender gap widened. We fully expect it to narrow post-COVID-19. Please note, the narrowing is not necessary a good thing as it represents the “gap” not “absolute” financial wellness. In tough economic times, both men and women tend to regress financially, women just regress at a slower pace.

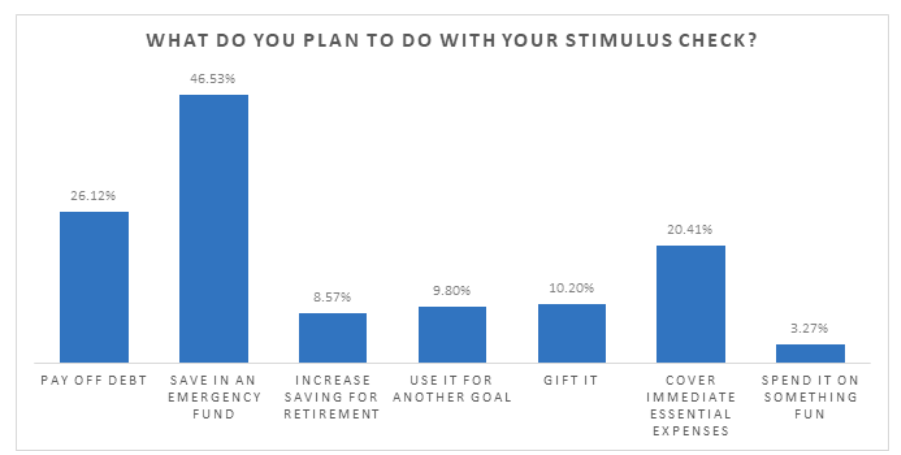

7. Question: How are employees planning to utilize their COVID-19 economic stimulus checks?

Answer: As part of our ongoing COVID-19 relief efforts, Financial Finesse hosts weekly webcasts aimed at helping employees navigate the day-to-day financial changes and decisions we’re all facing. In order to make these webcasts as relevant as possible, we created a follow-up survey and shared it with the thousands of employees who attended. One of the questions we asked was “What do you plan to do with your stimulus check?” Surprisingly, the majority of respondents that received a payment (47%) plan to put it toward an emergency fund. Only one in five (20%) indicated using it to cover immediate essential expenses. While there is no such thing as good news when it comes to COVID-19, we were excited to see most employees proactively saving their stimulus check versus reactively relying on it to cover immediate essential expenses.