The W-4: Getting Your Optimal Tax Refund

January 05, 2023Tax season can fill you with a sense of dread about filing your returns only to find out you must write a check to the IRS to boot. But the reality is that 76% of taxpayers who file actually get a refund rather than owe. That all sounds good on the surface; who wouldn’t want to get some extra cash every spring? But the reality is that a refund is really an interest-free loan to the government. It represents money you could have kept for your own purposes and goals during the year.

Striking the right balance involves meeting your tax obligations while keeping as much hard-earned money as possible.

Update Withholdings

The primary way we pay our taxes during the year (the IRS is a pay-as-you-go system) is through withholdings from our paychecks. The IRS form W-4 determines your paycheck withholding. Your employer keeps your W-4 on file as it determines the amount they should send to the IRS on your behalf. You can change your W-4 with your employer anytime you want to adjust your withholdings.

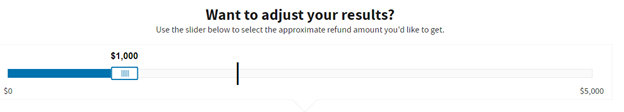

The IRS has a great tool to help you determine your withholdings and produce your desired outcome. First, you will need to gather information to help you complete the estimator correctly. For example, you’ll need pay statements, bonus information, side gig income, and your most recent tax returns. The output will then give you instructions to update your W-4 for an approximate refund of $0. You can also adjust the slider bar to get your desired result and determine what adjustments you need to make to your W-4.

The W-4 Form

Let’s look at the form itself in more detail:

- Step 1: This is your personal information, including your filing status. Update the form whenever your filing status changes (marriage, children, etc.), as that adjusts the withholding defaults.

- Step 2: This section helps coordinate multiple W-4 forms if you have more than one job or your spouse also works. The estimator detailed above will provide instructions for your family unit’s W-4 forms.

- Step 3: Input the number of qualifying children or relative dependents in your household. The larger the number you input in this step, the less tax the IRS will withhold to account for the child tax credit. Conversely, the fewer dependents noted in this section, the more tax you will have withheld.

- Step 4: Other adjustments can be input here. If you have other income that will not have withholding (e.g., interest, dividends, and retirement income), you can specify additional withholding to account for that. You can also indicate if you expect to itemize deductions this year and not take the standard deduction. You will want to refer to your most recent tax return to determine if you will likely itemize. Lastly, you can specify a set dollar amount of additional tax you want to withhold every pay period. For instance, if you had to write a check for $1,200 this past year and get paid twice a month, you can put $500 in line C to address that.

Other Considerations

You want to adjust your W-4 as your circumstances change. For example, one big thing that can throw a curveball is dependent children that age out of the child tax credit. Once those kiddos turn 17, they are no longer eligible for this credit, which can lead to surprises for parents when they file. So, again, run the estimator tool and update your W-4 when that happens to reflect a lower number of dependents. That will help to increase your withholding.

Ultimately, determining your optimal tax refund is a personal choice, but understanding the implications of getting that big refund needs to be a part of your planning. Get your intended results and avoid tax filing surprises by going through the IRS Tax Withholding Estimator and updating your W-4 forms accordingly.