3 Numbers That Matter More Than Your Credit Score

June 22, 2016While knowing your credit score and the elements that impact it is important to your overall financial well-being, I sometimes find that people are overly concerned about it at the peril of other more important financial measurements. Your credit score only really matters when you’re applying for a loan, certain types of insurance and increasingly, when applying for a job. If none of those things are on your horizon, then your score is more like your high school ACT scores – perhaps a point of pride, but pretty irrelevant for the time being. Here are three more important numbers you should be focused on instead:

Net Worth

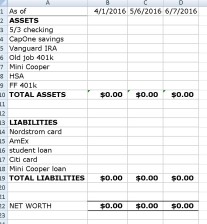

What is it: Assets (bank accounts, investments, home, car – basically cash or anything you could turn into cash) minus liabilities (credit card balances, car loans, student loans, mortgages, 401k loans – anything you owe).

Ideal number: As high as possible.

Why it matters: Your net worth is the ultimate measure of your ability to weather financial storms and maintain financial choices in life. The higher your net worth, the more financial freedom you can afford. There are countless cases of people who were millionaires on the asset side but broke on the net worth side as cautionary tales of neglecting this important number. Many of these people suffered during the last recession when their debts were called.

How to track it: I calculate my net worth on a monthly basis using Google sheets at the same time I sit down to set up any bill payments for the month. Here’s a snapshot of what it looks like:

One nice side effect of this is the fact that I’m checking on all of my accounts at least once a month, so I can also do a quick check for anything fishy.

Worth noting: I pay all my credit cards off each month, but I include them on this sheet because that’s money I still owe that is reflected in my checking account above. It’s the only way to have a truly clear picture of what I have. I keep things like my student loan and Mini Cooper loan on there both for historical accuracy as well as for the psychological thrill of seeing a big fat ZERO under old debts. It’s a little, “Yay me! Look how far you’ve come!” moment each month.

Retirement Readiness

What is it: The best way to measure whether you’re saving enough to retire comfortably when you want to, especially if you have many years to go until retirement.

Ideal number: On track to replace about 80% of your current income, unless you’re within 5 years of retirement (when you can be more specific about how much you’ll need each year).

Why it matters: Retirement, which really just means transitioning to living off your savings one day, is one financial goal that pretty much all of us share. Whenever anyone asks me what to do with extra money or if they can afford to take on an additional debt payment or savings goal, my first question is, “are you on track for retirement?” Even though it may be one of your longest-term goals, it should be in the top 3 in terms of priorities.

How to track it: There are countless calculators out there, but for people with a 401k or other workplace savings plan, I prefer this Retirement Estimator.

Worth noting: Many people who say they aren’t on track to retire have never run a calculator. Knowing is the first step!

Emergency Fund

What is it: A cash cushion in place to tap into in case of an unexpected loss of income due to job loss or extended illness or injury.

Ideal number: 3 months of expenses, minimum. For single income households or career fields that aren’t as certain, at least 6.

Why it matters: Life happens and when it does, having cash that’s easily accessible takes away much of the financial stress and allows you to focus your energy on finding a job, healing or adjusting to the new normal.

How to track it: If you’re starting from zero, start with a goal of setting three months of rent or mortgage aside. Then tack on three months of your next highest expense and so on until you have all essential expenses covered. Once you’re at three months, make sure you adjust for any changes such as a new home, new baby, etc.

Worth noting: It can be tempting to keep a credit card on hand instead of the cash or want to invest the cash for higher earnings, but resist. Should something happen, consider the probability that it could be due to an economic downturn when credit may not be as easily accessible and/or the stock market could be down. The best place for your emergency fund is in a high yield savings account.

These are the three numbers you want to focus on. Even if you’re not at the ideal numbers yet, you’ll be well on your way to financial freedom if you can find a way to track them on a consistent basis. And you just may find your credit score improving as well.